Tired of Struggling & Denials? Make Your Commitment to Growth and get Approved.

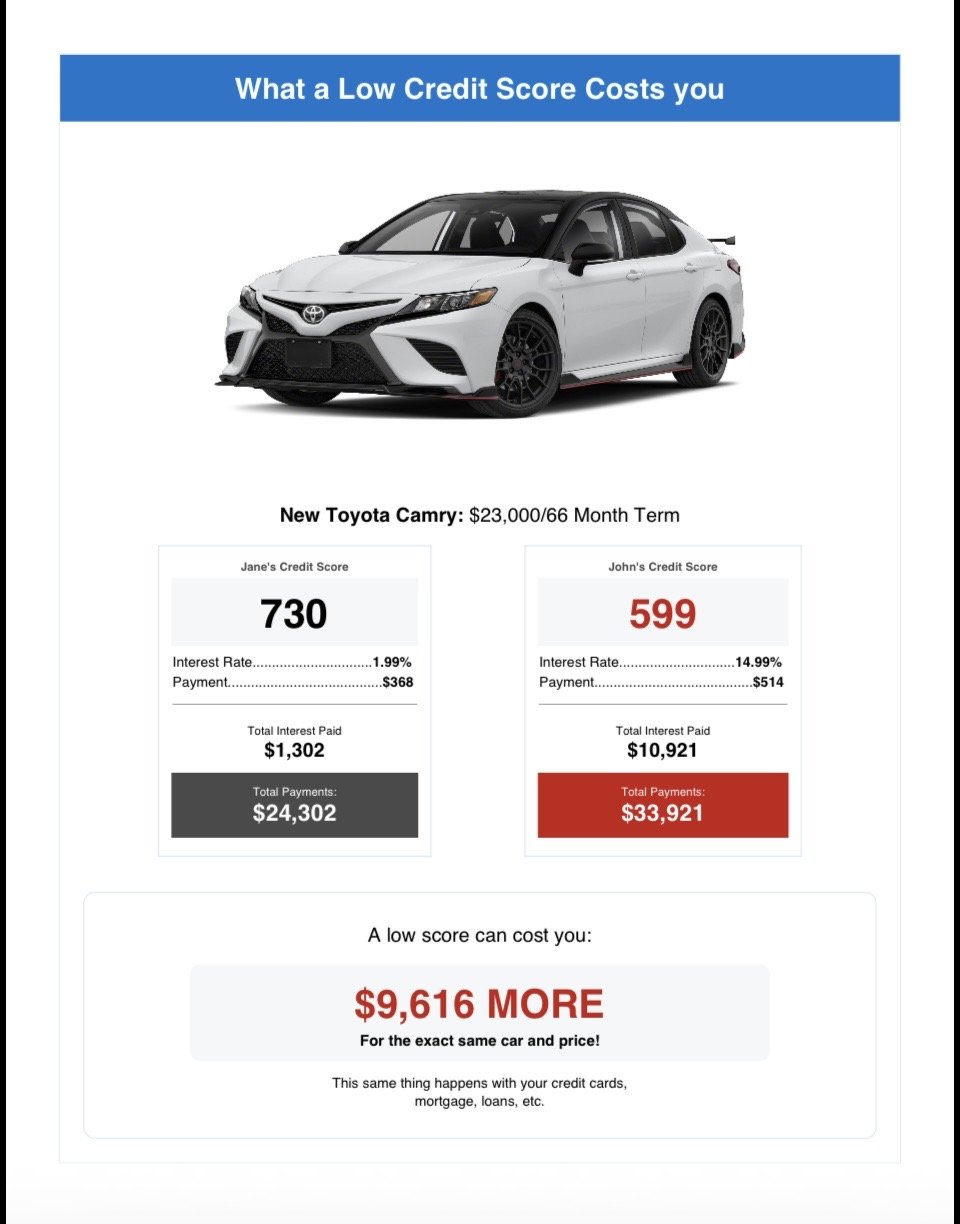

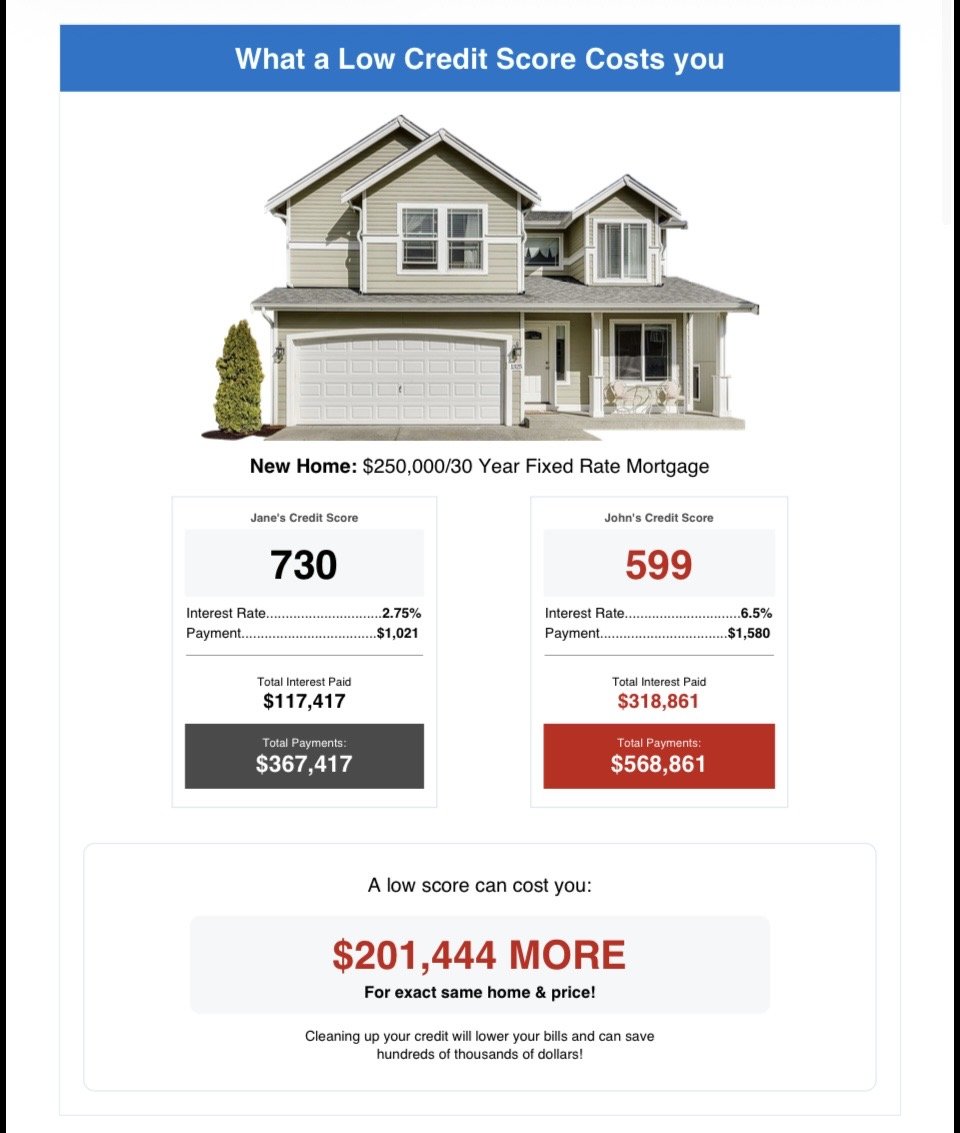

The Cost of Bad Credit

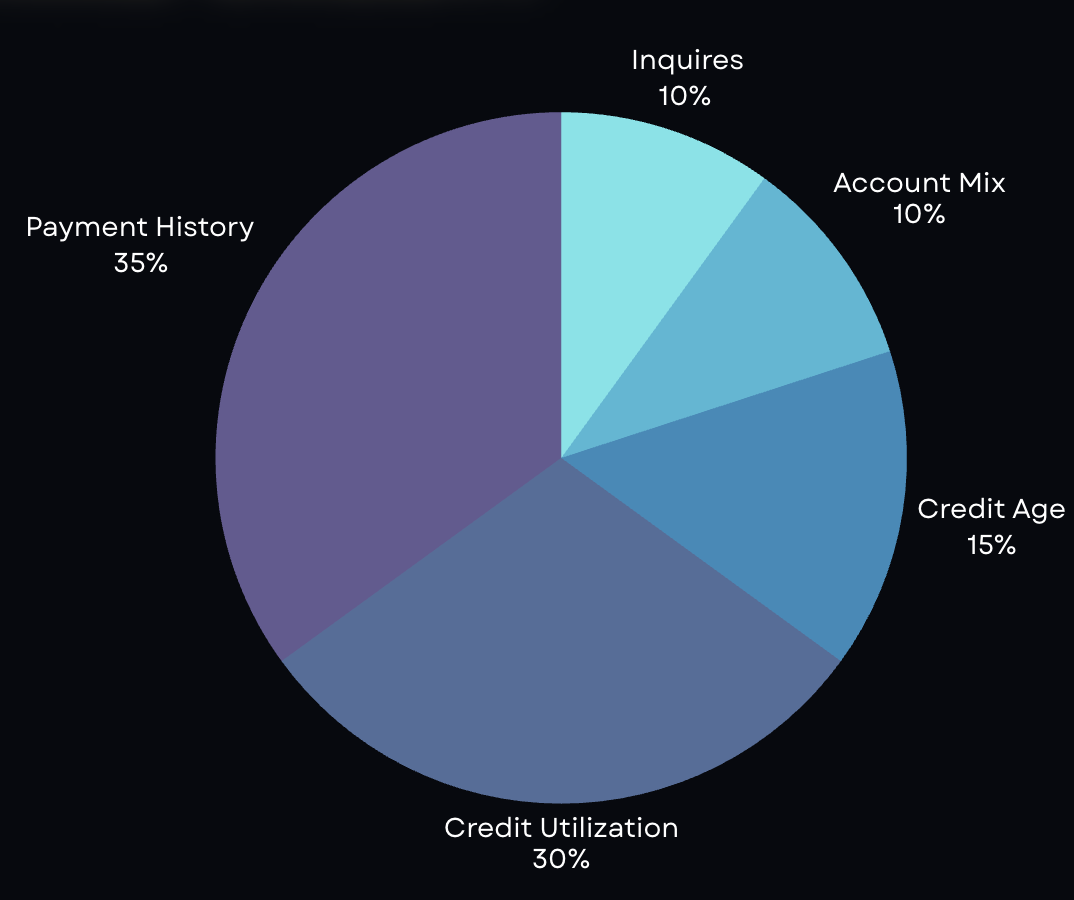

How is your credit score Calculated?

350-850 Possible Points

550 POINT BREAKDOWN

PAYMENTS=192.5

UTLIZATOIN=165

CREDIT AGE=82.5

ACCOUNT MIX=55

INQUIRIES=55

Payments & Utilization make up 65% of your score

Choose Your Pathway

For individuals who just need basic credit repair, to gain confidence for approvals

The Foundation Pathway is built for people who want their credit profile cleaned up the right way. If your report feels messy, inaccurate, or weighed down by negative items that do not look right, this is the starting point. The objective is simple: bring your credit file back to a clean, accurate, and defensible place so you can move forward with clarity.

We begin with a full credit report audit, then map out a strategy-first correction plan. From there, we challenge items that may be inaccurate, incomplete, unverifiable, or improperly reported, and we track responses and next steps as your file updates. You also get guidance on the habits that protect your progress, because cleanup works best when your day-to-day credit behavior matches the strategy.

This Pathway is ideal if you are not chasing high limits yet and you are focused on building a strong base for your best chance at approvals. A cleaner profile often creates better options over time, and if your goals change later, you can step into Elevation or Legacy from a stronger position. Results vary by file, and we cannot remove accurate and verified information, but we do focus on disciplined execution and maximum-accuracy standards.

For individuals ready to strengthen their credit profile with greater intention and move with higher-level strategy.

The Elevation Pathway is designed for clients who are ready to move beyond general cleanup and start using personal credit with intention. If your goal is to qualify for stronger cards and higher limits, this Pathway focuses on positioning your profile the way lenders often evaluate it, then building a clear strategy for what to improve before you apply.

You receive the same professional credit correction workflow as the Foundation Pathway, but Elevation adds a higher level of guidance around personal credit optimization and credit stacking sequencing. We identify what is suppressing approvals and limits, then map out the steps that may strengthen your profile over time, including utilization strategy, revolving account positioning, inquiry management, timing, and application discipline. The goal is to reduce guesswork and help you approach applications with a plan instead of hope.

Underwriting decisions vary by lender and by file, and results are never guaranteed. We do not remove accurate information. What we do provide is structure, strategy, and execution, so you can pursue high limit personal credit cards from a stronger, cleaner position.

Affiliate Partners

Welcome to Evian Alexandre Wealth Nexus — We support referral partners by providing a clear, documented client experience from intake through completion. If you serve clients who get stalled by credit, we help you keep momentum without adding operational burden to your team.